The essentials of managing casino customer demand to optimize profit.

By Sue Murphy CRME, ComOps

Introduction

Casino hotels comprise only a tiny fraction of hundreds of thousands of hotels across the world. Perhaps due to this limited scope, the industry lacks universal performance metrics, and casino customers might find frustratingly varied booking experiences across different brands. The ongoing legalization of gambling-related activities, however, has fueled growth in the commercial and tribal casino industry over the past few decades. With casinos now in almost every state in the US, knowledge about gambling operations, loyalty programs, and marketing tactics is increasingly prevalent. Gaming operators have long expanded into other hospitality industries and, recently, online. Resort casino properties often host a vast array of offerings, including gourmet restaurants, spas, golf courses, and of course, hotels. About 30 percent of almost one thousand casinos across the US have a hotel on site. In most cases, the hotel is viewed as an amenity to the casino and not the other way around.

How do ownership groups and leadership teams ensure they get the most out of each room and measure success accordingly? What does casino segmentation look like compared to customary market segments, and how can casino hoteliers ensure they provide the best experiences to their most valuable customers? This paper aims to address some of these questions, explicitly targeted at the revenue management of casino hotel properties.

Since its inception in the airline industry more than 50 years ago, revenue management has

been applied across various industries and sectors. Already widely implemented to optimize airplane seat and hotel guest room revenue, revenue management has expanded into other profit centers, including cruises, convention space, restaurants, spas, golf courses, entertainment venues, and car rentals. The discipline has also extended outside travel and leisure to short-term housing rentals, storage units, and even hospital beds, to name some.

Businesses of all leanings benefit from maximizing revenue and profit from perishable inventory. For many hotels and resorts, ancillary non-room spend can be well over 50 percent of total revenues. This is probably most true for casino hotels, where the vast majority of property income is generated on the gaming floor.

It should come as no surprise to learn that casino hotel management companies were especially keen to adopt and implement the practice of revenue management and apply it to their casino guests. Yet while the ability to yield gaming revenue from casino segments is among the more crucial components of maximizing hotel worth in a casino environment, it is perhaps the least well-understood. Successful revenue management in a casino hotel requires in-depth knowledge of the gaming customer and an ability to measure projected guest worth. Revenue optimization also requires that all hotel demand is yielded. This means casino guest reservations are booked based on customer worth without preset offers or ‘guaranteed’ rates. The combination of understanding guest worth and yielding all demand allows for optimal revenue and profit.

Casino customer valuation and segmentation

Segmentation

Segmentation is a critical component of any successful

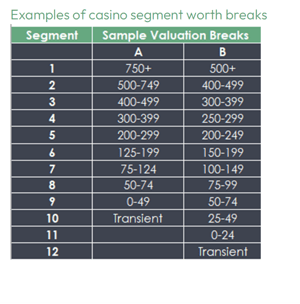

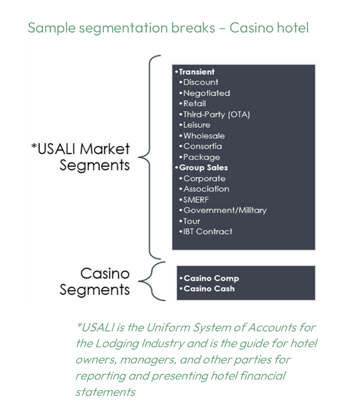

hotel revenue optimization strategy. In casino hotels, the worth breakout for gaming guests is essential, but it is also necessary to understand the non-casino business mix. Increasingly, casino hotel properties analyze their hotel business on two levels—one for traditional market segments and the other for specific casino segments. The main difference between the conventional market segments in casino vs. non is the need to include ‘casino’ as a source of business. For financial purposes, hotel leadership must ensure the casino source is further broken down into “cash” room nights and “free” or “comp” room nights, as demonstrated in the example provided.

Valuation

The casino segments, as defined above, work for financial reporting and budgeting but are

insufficient for yielding purposes; hotel leadership has to collaborate with marketing to build

out additional breakdowns based on projected customer worth. The guest’s worth segment

dictates whether they will receive a discounted cash rate, a comp offer, or a combination of

both.

Casino customer valuation requires a data warehouse with detailed revenue tracking at the

individual guest level. Fortunately, a player database is the foundation of most casino loyalty

and marketing programs. Casino customers are heavily incented to use a loyalty club or a

“players card” to reap rewards such as free slot play, complimentary dining, and room nights. For chains or multi-property entities, a universal database is a best practice, encouraging loyalty to the brand and enhancing the customer relationship. The loyalty database will include various levels or tiers ranging from brand new customers to the most loyal ‘VIP’ guest. A customer’s tier level is based on their cumulative worth, derived from slot and table play, but increasingly RM teams are incorporating non-gaming ancillary spend (cash spend for hotels, F&B, etc.), and casino management companies are starting to integrate sports betting and online gaming with the recent advent of both in several markets.

While cumulative worth or loyalty can be a factor in the hotel valuation, from a hotel revenue standpoint, it is necessary to understand a customer’s projected worth for each night of their stay. The customer valuation is usually an in-depth formula incorporating trip and play history to devise an average nightly estimate of a guest’s potential future worth. This estimated worth (or profit) value, along with the forecasted demand, dictates the price quoted to that

guest. More precisely, the value determines the customer’s segment and dictates pricing at the segment level. A hotel gaming enterprise can decide which segment breaks are best suited

to their business, just as they will want to customize the customer valuation for their needs. A smaller property, for example, may have fewer segments but more breaks at the higher worth end of the database. Certain hotels in high frequency markets may ignore non-hotel trips in the valuation as it would be less predictive of their play behavior during their stay. More info in: “The Revenue Director & Casino Customer Valuation” by Matt Flemming,

https://www.comops.com/our-insights.